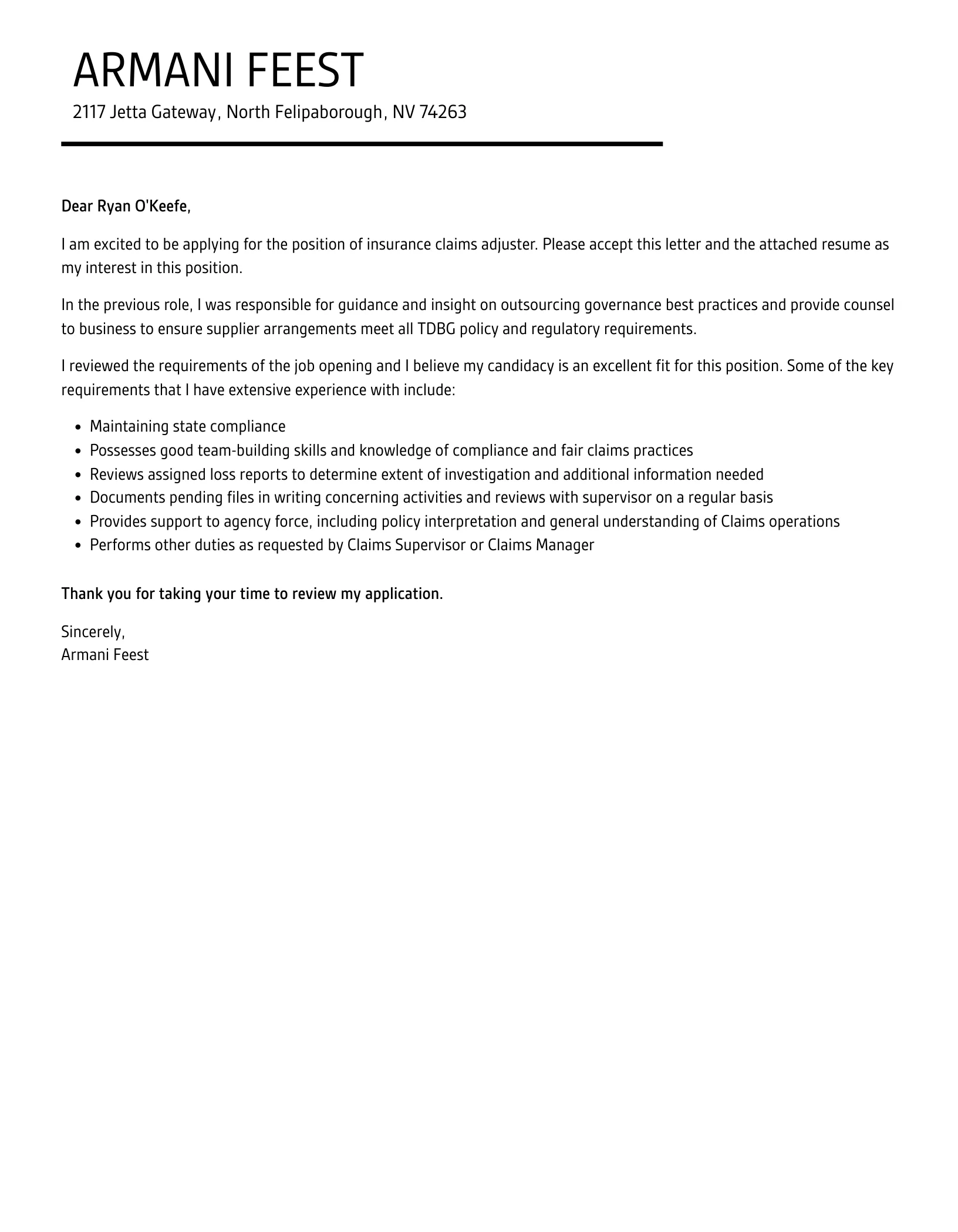

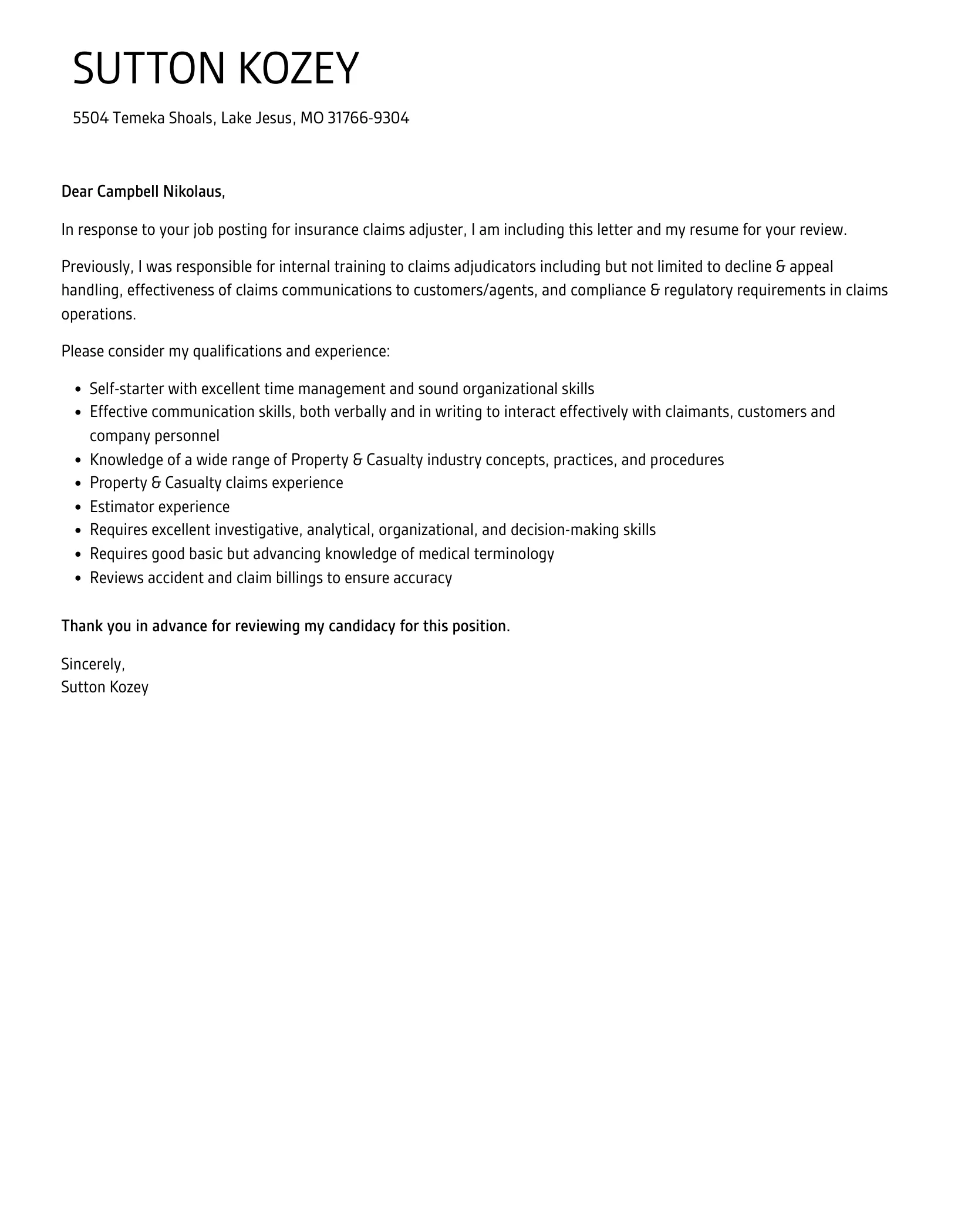

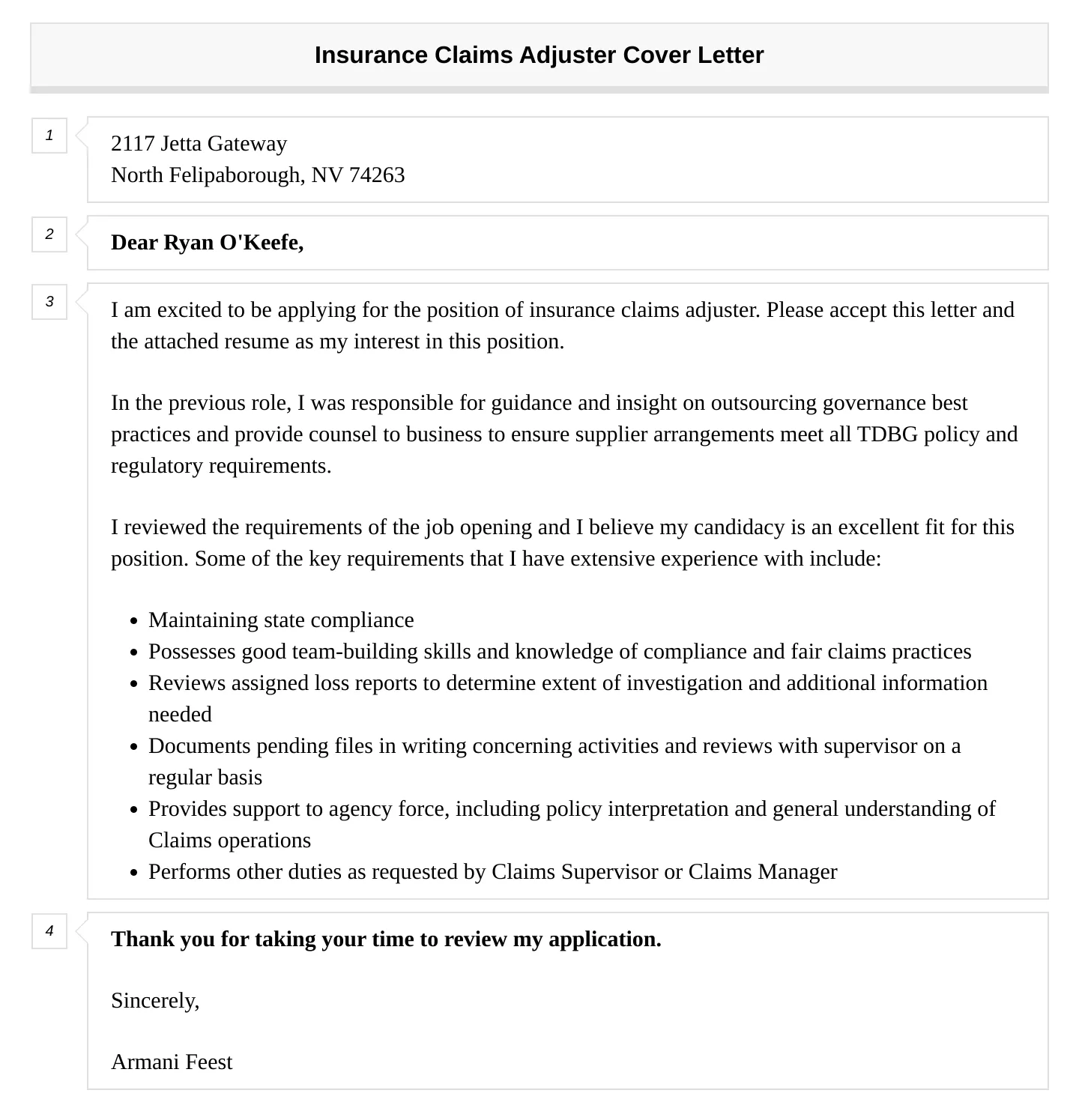

A compelling cover letter is your first opportunity to make a strong impression on a potential employer and secure your spot in the interview process. Especially in the competitive field of insurance claims adjusting, a well-crafted cover letter can set you apart from the crowd. This guide provides detailed insights on how to create a standout insurance claims adjuster cover letter that highlights your skills, experience, and enthusiasm for the role.

Highlight Your Relevant Skills

Your cover letter should immediately showcase the skills that are most important to the role of an insurance claims adjuster. Focusing on these key competencies will help you demonstrate that you possess the core qualities required to excel in this profession. The ability to clearly articulate these skills, supported by specific examples from your professional background, will significantly enhance your chances of getting noticed. Remember, the goal is to demonstrate that you’re a great fit for the job.

Investigate and Assess

Claims adjusters are masters of investigation, gathering all necessary information to reach accurate conclusions. Your cover letter needs to highlight experiences where you demonstrated the ability to meticulously collect and evaluate data. Mention instances where you were involved in gathering evidence, interviewing witnesses, and analyzing documentation. Demonstrate your capability to identify critical details and apply logic in assessment processes.

Communication

Effective communication is at the heart of any successful claims adjuster’s work. This entails explaining complex situations clearly, both verbally and in writing. Showcase your experience in dealing with various stakeholders – claimants, legal representatives, and internal teams. Mention instances where you used clear, concise language to deliver explanations and manage expectations. Highlight your ability to adapt your communication style to different audiences.

Problem-Solving

Claims adjusting often requires creative problem-solving to navigate complex situations and find fair resolutions. Your cover letter needs to demonstrate your aptitude for identifying problems, analyzing potential solutions, and implementing the most effective strategies. Provide examples of instances where you overcame obstacles, worked through difficult claims, and achieved positive outcomes. Be ready to share how your strategies led to favorable results.

Detail-Oriented Approach

Precision is a must in the world of claims adjusting. Your cover letter should reveal your capacity to pay attention to detail, avoiding errors and oversights. Provide evidence of times where you meticulously reviewed documents, verified information, and maintained precise records. Highlight the processes you followed to ensure accuracy in your work. Emphasize your commitment to being thorough in every aspect of the job.

Showcase Your Experience

Besides skills, your experience is a valuable asset. Presenting a clear picture of your experience will greatly enhance your cover letter. Your goal is to demonstrate how your professional history is directly aligned with the job requirements. By focusing on relevant experiences, you highlight your capability to immediately contribute to the company’s success. Ensure your experience is directly connected to the role you are applying for.

Quantify Achievements

Quantifying your achievements adds substantial weight to your claims. Instead of simply stating what you did, show what you accomplished. Whenever possible, include specific metrics to demonstrate the impact of your work. This might involve the amount of claims you processed, the efficiency gains you achieved, or the cost savings you contributed to. Use data to present a clear picture of your contributions.

Provide Relevant Metrics

To showcase the tangible outcomes of your work, use relevant metrics to support your claims. For example, if you mention that you improved processing times, state by how much. If you mention reducing costs, specify the percentage or dollar amount. If you improved customer satisfaction, include the specific improvement. These measurable results speak volumes about your capabilities and the value you bring to the table.

Tailor to the Job Description

A generic cover letter won’t cut it. Tailoring your letter to each job description is a must for showing your genuine interest and understanding of the position. Carefully review the job posting and customize your letter to match the specific requirements and qualifications the employer is seeking. Customizing shows that you’ve taken the time to understand the role and how your skills align with it.

Research the Company

Before starting your cover letter, research the company to show your understanding of its culture, values, and mission. This information allows you to align your letter with the company’s goals. It helps you demonstrate that you’ve thoroughly prepared for the application and that you are truly interested in the opportunity. This approach can significantly enhance your chance of getting noticed.

Address Specific Requirements

Carefully review the job description and directly address any specific requirements or qualifications the employer has listed. If the job posting emphasizes specific software, experience, or skills, make sure you highlight your relevant experience. Explicitly linking your qualifications to the requirements shows the employer that you possess the necessary skills and experience to succeed in the role. Your attention to detail and understanding of the job will shine through.

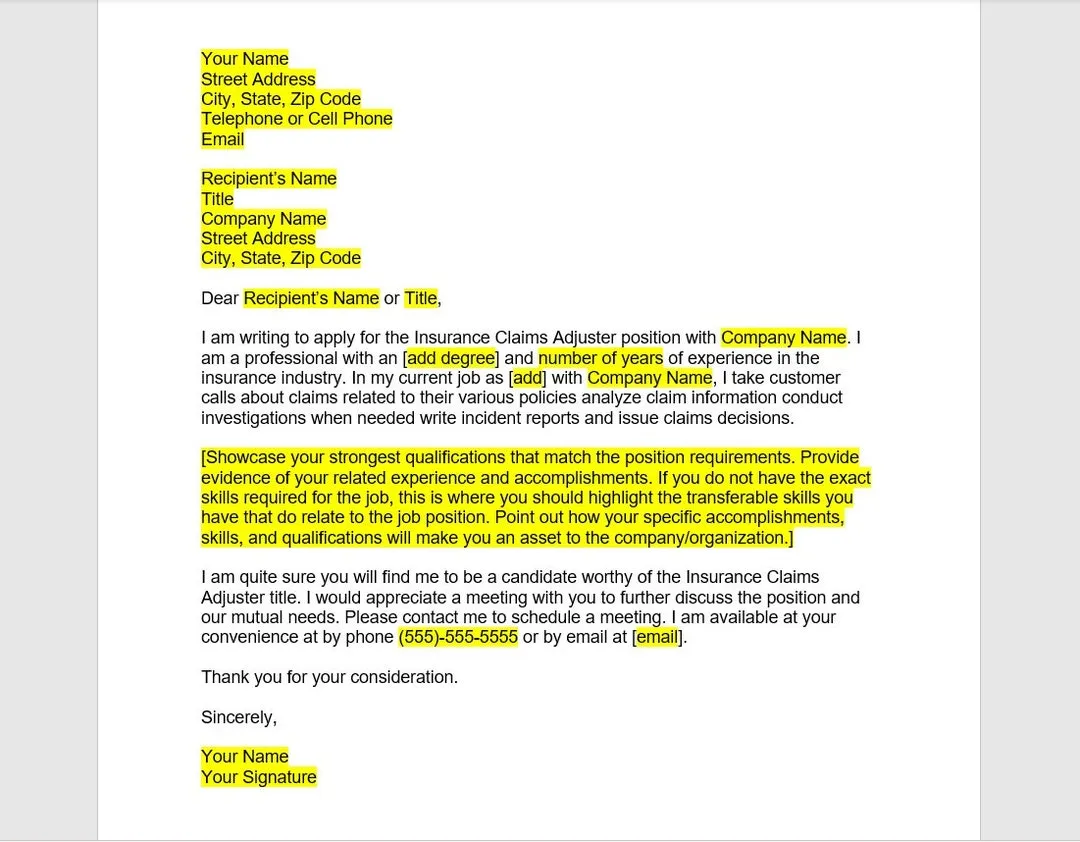

Format and Structure

A well-formatted cover letter is just as important as the content it contains. It creates a professional impression that showcases you can communicate effectively. A clear structure helps readers easily follow your key points and understand your value. A well-structured and properly formatted cover letter greatly enhances its readability and impact.

Professional Tone

Maintaining a professional tone is critical throughout your cover letter. Use formal language, and avoid slang, abbreviations, or overly casual phrasing. Ensure your tone is respectful and confident. This approach reinforces your professionalism and shows your understanding of workplace decorum. A professional tone helps to create a positive first impression.

Concise Language

Keep your language clear and concise. Avoid using long, complex sentences and jargon. Get straight to the point, conveying information efficiently. This will make it easier for the hiring manager to understand your message. Conciseness demonstrates your ability to communicate clearly and effectively in writing. This skill is vital in the insurance claims adjusting profession.

Proofread Carefully

Always proofread your cover letter before submitting it. Check for grammatical errors, spelling mistakes, and typos. Having errors can suggest a lack of attention to detail. Proofreading shows that you value accuracy and professionalism, which are crucial attributes for a claims adjuster. Ask a friend or family member to review your cover letter for another set of eyes.

Call to Action

Close your cover letter with a strong call to action. Your goal is to encourage the hiring manager to take the next step, whether it’s scheduling an interview or reaching out to you for more information. A well-defined call to action clearly signals your interest in the position and the next steps you anticipate.

Express Interest

Reiterate your enthusiasm for the role and the company in your closing paragraph. Reaffirm why you are an excellent fit for the position and express your genuine interest in the opportunity. This helps to reinforce your enthusiasm and commitment to the role. Be sure to clearly communicate your eagerness to be part of the team.

Offer to Provide Additional Information

Close by offering to provide additional information, such as references or more detailed examples of your experiences. This shows your willingness to go the extra mile and provide all necessary details to support your application. By making yourself available for any further inquiries, you confirm your interest and dedication to the opportunity. Include your contact information.

In summary, writing a great insurance claims adjuster cover letter involves highlighting key skills, showcasing experience, and tailoring the letter to the specific job description. By following these guidelines, you’ll be well-equipped to create a compelling cover letter that impresses potential employers and helps you land your dream job. Good luck!